- #Tracking personal expenses in quickbooks online software#

- #Tracking personal expenses in quickbooks online windows#

This law addresses employee expense abuses and imposes draconian penalties on companies that lack effective internal expense controls. One product requirement for the finance department is that it support company compliance with the Sarbanes-Oxley Act (SOX). A good solution covers everyone's bases while improving productivity and saving the business, and its employees, time and money. This includes accurate expense tracking, the capability to work within a company's policies, and at the same time provide the tools for timely employee reimbursement. A good system needs to be transparent and straightforward but also efficient in a number of areas.

Mostly because the product needs to make sense to the finance department as well as the employees.

#Tracking personal expenses in quickbooks online software#

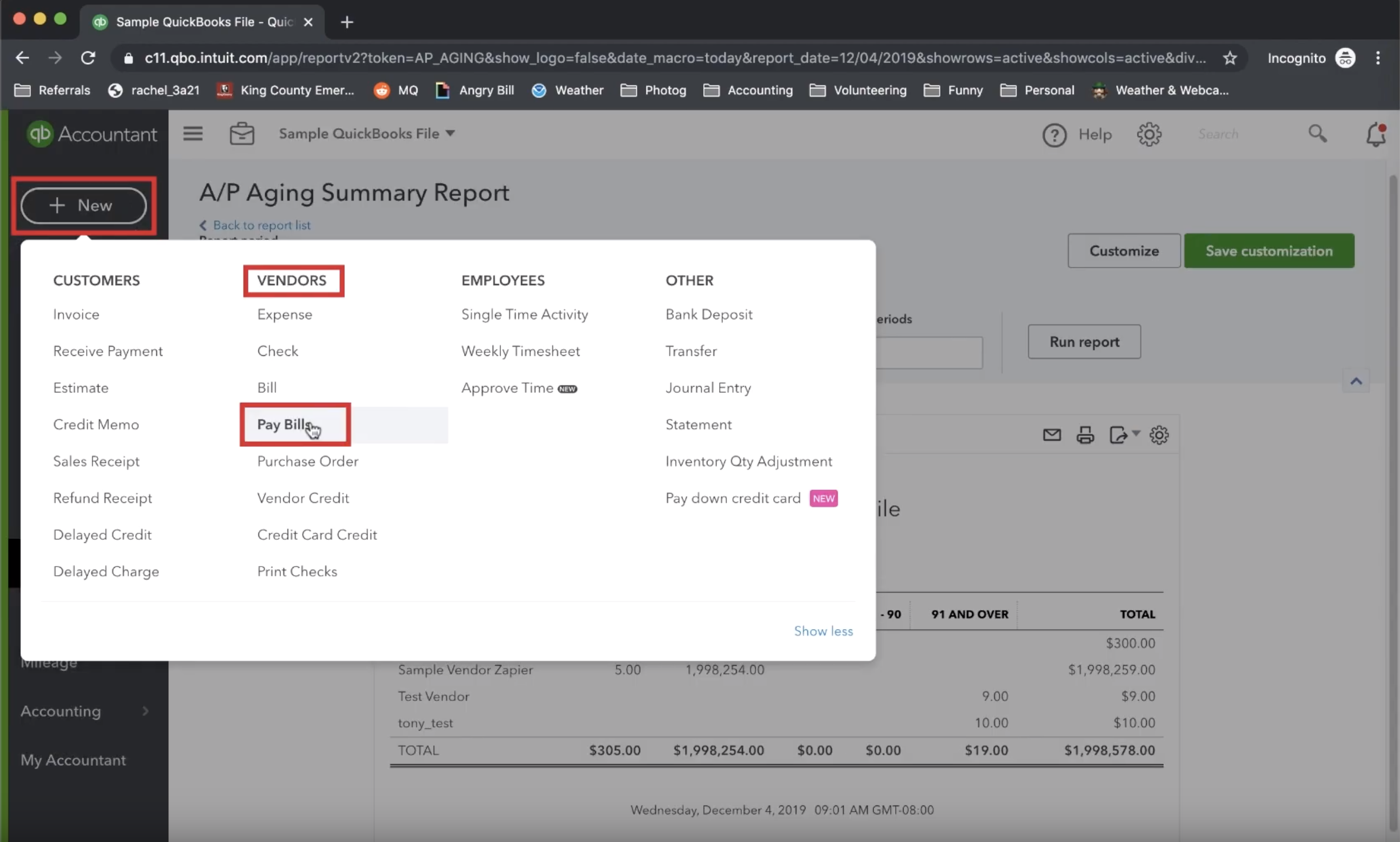

On the finance side, does your bookkeeper and CPA use QuickBooks Online Plus, or is your business based on more advanced accounting software like enterprise-grade general ledger accounting software? Choose a product that you're sure will integrate with the existing software powering your accounting chain your money-managers will thank you for it.Ĭreating a solid and intuitive SaaS expense tracking and reporting solution is a daunting task.

#Tracking personal expenses in quickbooks online windows#

Some products support use of Windows phones, but don't get too comfortable with that platform since Microsoft will be discontinuing support for this format in December. If your mobile workforce uses iPhones or Android-based smartphones, you're in luck since most SaaS products do have apps for these platforms. A solution that's confusing, difficult to use, or worse, buggy in its integration with your back-end systems will make employees avoid using it, which is exactly what can kill an effective expense tracking solution. It's important to minimize employee learning curves so they will be up to speed on the new product with minimal brain drain and collateral costs. Add this to your must-have business intelligence (BI) data. Next, take a look at the back-end technology your company is using, especially its accounting software. Use this information to create loose policies and rules based on location, company averages, and what you deem appropriate. This may sound like overkill but it will come into play if you need a multi-tiered approval feature. Create an organizational map including the reporting/supervisory structure. What are those average expenses? Are they reasonable or do you think individuals are taking advantage? Look beyond the averages since a tool that suits a sales team on the road may not be ideal for the remote employees who visit the home office every quarter. Is it based in the United States? Does it do international business? What kinds of expenses are typically initiated by the workforce? A good place to begin is with a thorough audit of how many employees in your company submit expenses for reimbursement, including travel, business meals, and even office supplies. Find the Right Expense Tracking Softwareīefore you can choose SaaS expense tracking software, you have to examine your organization in some detail. Let's look at the top solutions we've tested. The best news for businesses is that cloud-based expense tracking software generally costs less while offering more innovation than on-site legacy hardware/software-based solutions.

0 kommentar(er)

0 kommentar(er)